Our portfolio return/risk looks all right, though the SP500 has a higher expected return for just a bit more risk. Ggplot(aes(x = stand_dev, y = expected_return, color = asset)) + Summarise(expected_return = mean(returns), Theme_update(plot.title = element_text(hjust = 0.5)) # This theme_update will center your ggplot titles Before we get to beta itself, let’s take a look at expected monthly returns of our assets scattered against monthly risk of our individual assets. It’s also telling us about the riskiness of our portfolio - how volatile the portfolio is relative to the market.

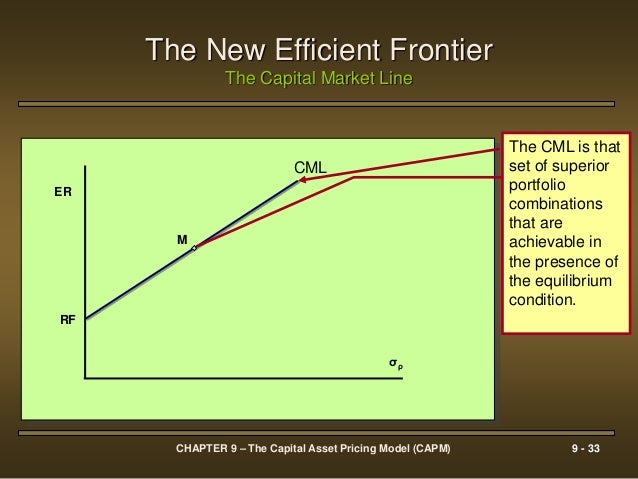

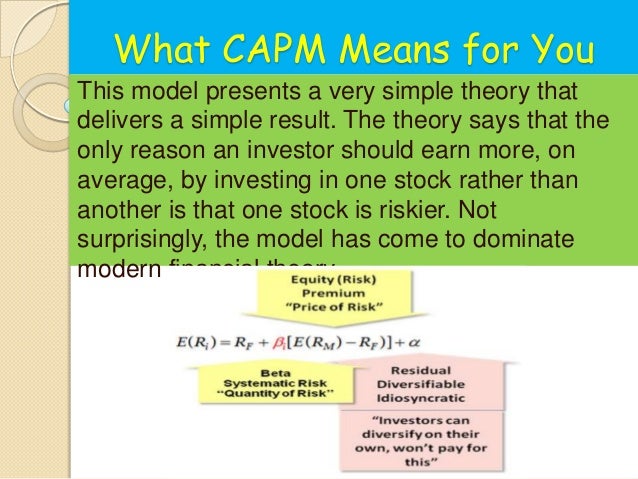

The CAPM beta number is telling us about the linear relationship between our portfolio returns and the market returns. Visualizing the Relationship between Portfolio Returns, Risk and Market Returns + asset_returns_long (a tibble of returns for our 5 individual assets) + beta_dplyr_byhand (a tibble of market betas for our 5 individual assets) + market_returns_tidy (a tibble of SP500 monthly returns) I will not present that code or logic again but we will utilize four data objects from that previous work: + portfolio_returns_tq_rebalanced_monthly (a tibble of portfolio monthly returns) Today, we will move on to visualizing the CAPM beta and explore some ggplot and highcharter functionality, along with the broom package.īefore we can do any of this CAPM work, we need to calculate the portfolio returns, covered in this post, and then calculate the CAPM beta for the portfolio and the individual assets covered in this post. + EEM (an emerging-mkts fund) weighted 20% + IJS (a small-cap value fund) weighted 20% + EFA (a non-US equities fund) weighted 25%

CAPITAL ASSET PRICING MODEL EQUATION HOW TO

In a previous post, we covered how to calculate CAPM beta for our usual portfolio consisting of: + SPY (S&P500 fund) weighted 25%

0 kommentar(er)

0 kommentar(er)